There are many aspects to consider when selecting an investment consultant. In this article, you will learn about Fiduciary responsibility, conflicts of interest, Hourly rates, and Retainer fees. Make sure you choose an investment advisor who complies with these regulations. Register your advisor with the Securities and Exchange Commission, or the state securities agency.

Fiduciary responsibility

A fiduciary duty requires investment advisors to act in the client's best interests and disclose material facts to avoid conflicts of interest. An infringement of fiduciary obligation can lead to financial liability as well as civil liability. Excessive trading, improper margin trading and false representations regarding securities are all examples of violations of fiduciary obligation.

Fiduciary duty requires investment advisors to act in the client's best interests, with the client's interests at the forefront of their decisions. This means they have to make sure that the advice they offer is in line with the client’s goals. To do so, the advisor must obtain sufficient information about the customer's financial situation. Fiduciaries usually decide what is best for the client and then discuss it with them.

Conflicts between interests

Potential conflicts of interest must be disclosed to clients by investment advisers. This disclosure must disclose the nature and management of the conflict as well as how the adviser plans to mitigate it. It must be disclosed at time of initial recommendation as well as every time an adviser recommends an investor hold an investment. Whether or not an adviser has a conflict of interest depends on the specific circumstances of the relationship between the adviser and the client.

A conflict of interests is when the financial interests and client of an investment advisor do not coincide. For example, an investment professional may have a financial incentive to sell a certain security. The advisor gets a commission when an investor purchases the security. Advisors will be more inclined to find the best investments, as they will receive the highest commissions.

Hourly rates

Investment advisors may charge flat fees, hourly rates or other fees for their time with clients. These fees are usually stated upfront. Before paying for any services, clients should see an invoice. Hourly rates vary depending on the advisor's experience and specialty. More experienced advisors charge more.

Firms that offer investment advice often use the hourly pricing model. An hourly rate is acceptable if the service is not repeated. However, if you need ongoing management, a flat rate or a percentage fee may be a better option.

Retainer charges

Although commission-based advisors are attractive for their low cost, they may not be the right choice for every client. These advisors are salespeople who earn commissions based upon the sale of financial products to their clients. These products may include mutual funds, stocks, or insurance. Retainer-based advisors do not charge commissions and can be more transparent.

Retainer-based financial advice is a great way to avoid conflicts of interests. The advisor receives a percentage (or two percent) of the client's portfolio value. An example: If the client has $500,000 in assets, the advisor could earn $5,000 to $10,000 per year. This type of arrangement can be costly and may create conflict of interests. Some retainer-based financial advisors also earn an ancillary income through the implementation of a client's investment plan.

How to choose an investment advisor

Your most important financial decision is making the choice of an investment advisor. It's important to choose someone who is registered and accredited, has a proven track record of success, and offers you a variety of investment products and advice. The Investment Industry Regulatory Organization of Canada (IIROC) regulates all Canadian investment brokers and monitors compliance.

There are many types of advisors. The best advisor for your company will depend on your goals. Although past successes do not guarantee future results, having a strong relationship can build trust and open communication with an advisor. Look for someone who communicates with their clients regularly and focuses on long-term goals rather than just making short-term decisions based on emotions.

FAQ

What skills is required to consult?

A consultant should have strong analytical skills as well as interpersonal skills. This is important because you are working on projects where you may not know exactly what you are doing. You will need to learn how you manage people and solve problems quickly.

You also need to have excellent communication skills. Clients expect a response within 24 hours. If they don’t hear back, they assume that you aren’t interested. It is vital to inform them and make sure that they are fully informed.

What are some of the advantages to being a Consultant?

Consultants often have the option to choose when and what they do.

This means you can work whenever you like and wherever you wish.

It also means you can easily change your mind without worrying about losing money.

Finally, you have the ability to control your income levels and establish your own schedule.

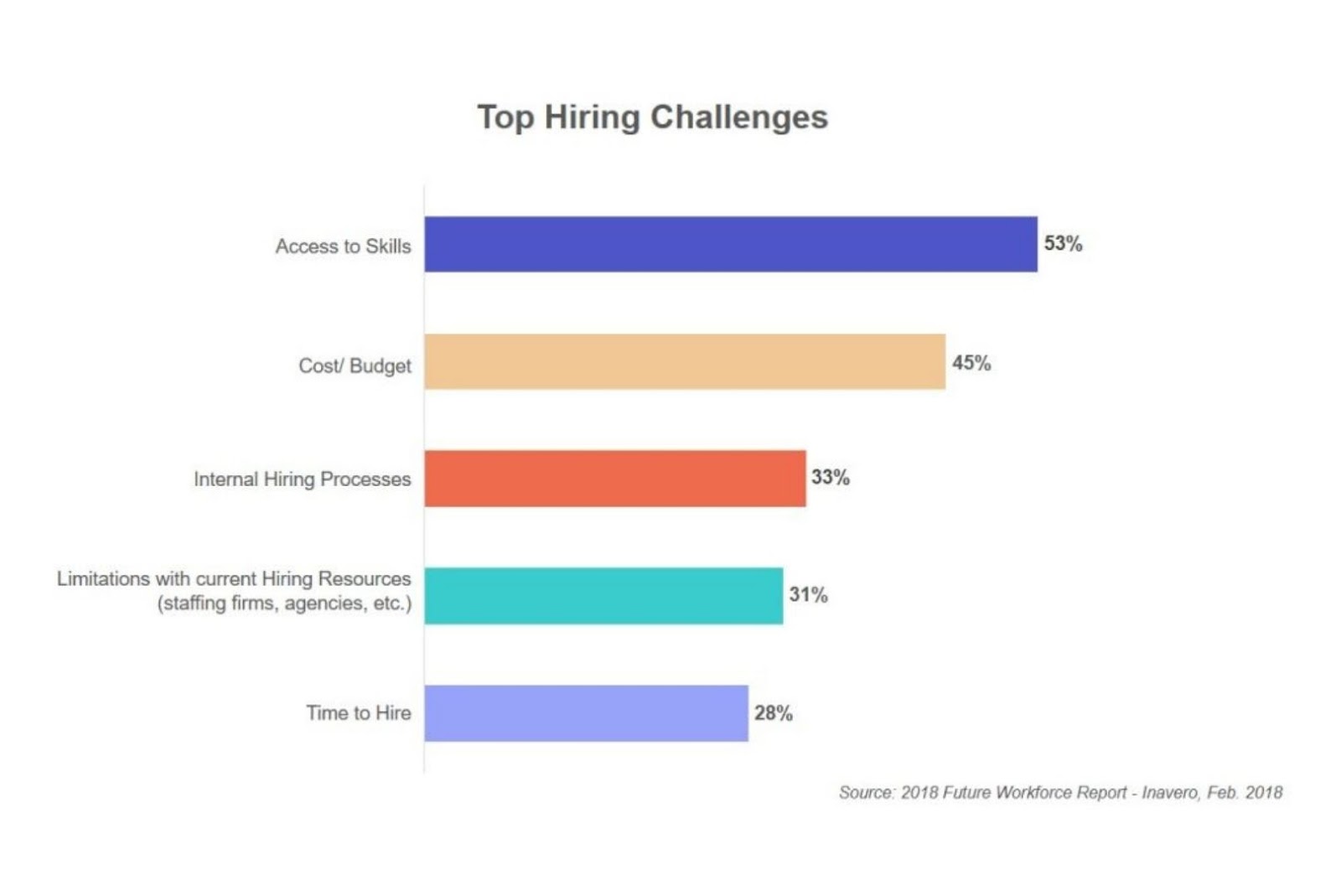

Who hires consultants

Many organizations have consultants who help them with projects. These include small businesses, large companies, government agencies and non-profits.

Some consultants work directly with these organizations while others freelance. The hiring process will vary depending on the complexity and size of the project.

Many rounds of interviews are required when hiring consultants. Then, the final decision will be made about who you believe is best for the job.

Statistics

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

External Links

How To

How can you find the best consultants?

First, ask yourself what kind of consultant you are looking for. Before you begin looking for a consultant, it is important to know what your expectations are. Before you start looking for a consultant, make a list. These could include professional expertise, technical skills and project management abilities, communication skills, availability, and other things. After you have listed your requirements, it might be a good idea to ask colleagues and friends for their recommendations. Ask them if they had any bad experiences with consultants previously and see how their recommendations compare with yours. Do some internet research if they don't have recommendations. You can post reviews on your previous work experiences on many websites like LinkedIn, Facebook and Angie's List. Take a look at comments and ratings from others, and use that data to find potential candidates. Once you have a short list of candidates, contact them to arrange an interview. At the interview, it is important to discuss your requirements and get their feedback on how they can help. It doesn't really matter if they were recommended; as long as they understand your business objectives, they will be able to show how they could help you achieve them.